Sales or purchases that involves bad debts will reflect the new tax codes changes. Greetings from Deloitte Malaysias Indirect Tax Team.

Charging GST at 0 the supply of goods and services if they export the goods out of Malaysia or the services fall within the description of international services.

. Any non-resident company receiving income from the use of or right to use software or the provision of services. In fact exempting essential m. Explanation of Government Tax Codes For Purchases.

However essential medicines are exempted. The out-of-scope supply must comply with Malaysia GST legislations to. Input tax allowed on the acquisition of goods or services by local authority or statutory body.

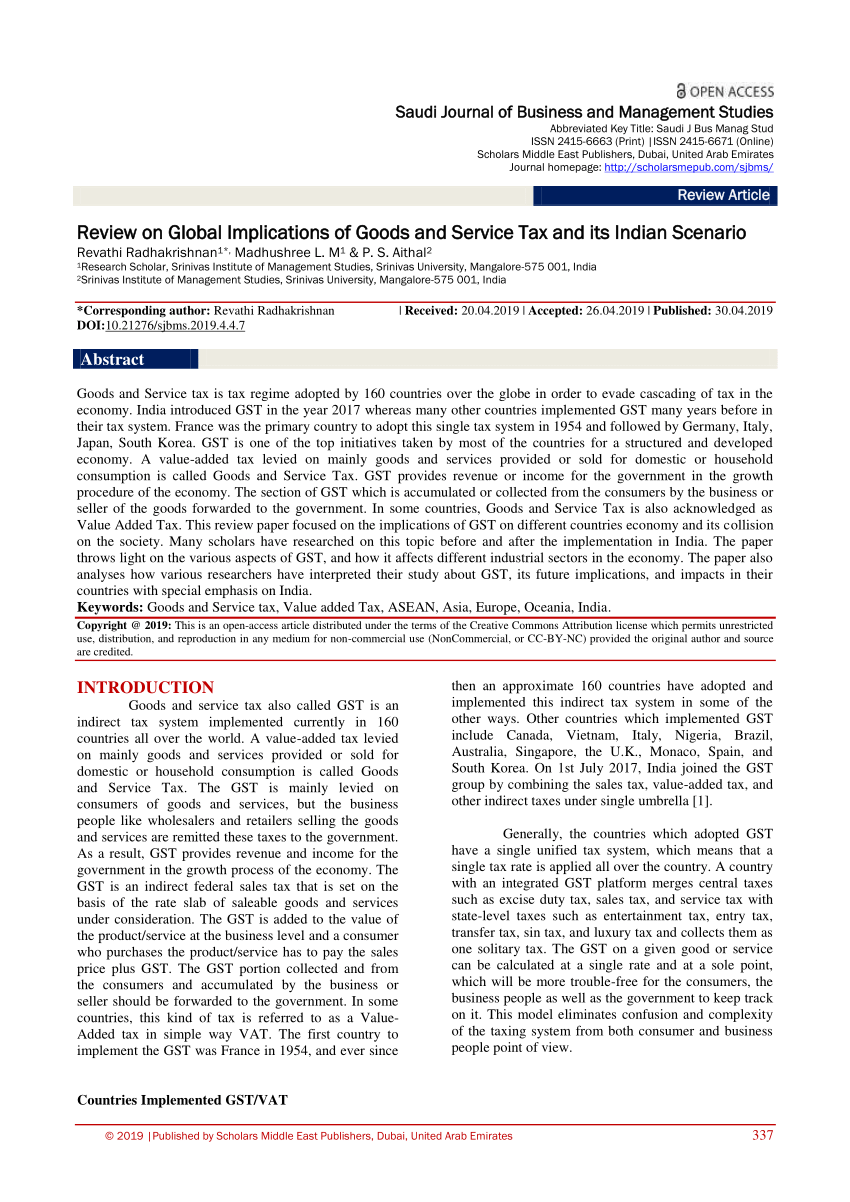

Withholding tax is applicable on payments for certain types of income derived by non-residents. GST on import of. The Reserve Bank today said it will be challenging to roll out GST from April 1 2017 but the new indirect tax regime will eventually boost business sentiment and investments.

Enter GST Posting Date in Purchases Module Customs Malaysia requires to report GST posting date for purchases made. The Amnesty scheme will be applicable for all pending. In Malaysia the goods and services tax GST was implemented in 2015.

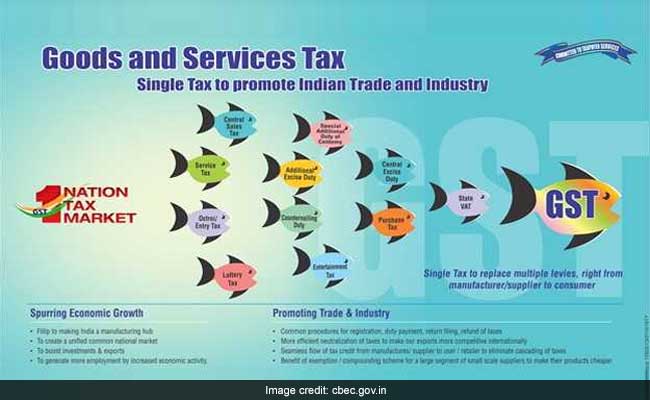

Gst Tax Code List Malaysia 2017 Https Assets Kpmg Content Dam Kpmg Xx Pdf 2017 11 Ess Survey 13 Nov 17 Pdf. GST is levied on most transactions in the production process but is refunded with exception of Blocked Input Tax to all parties in the chain of production other than the final consumer. Gst tax code list malaysia 2017 52022 dated March 25 2022 unveils an Amnesty Scheme 2022 to settle outstanding tax dues pertaining to the period before GST introduction.

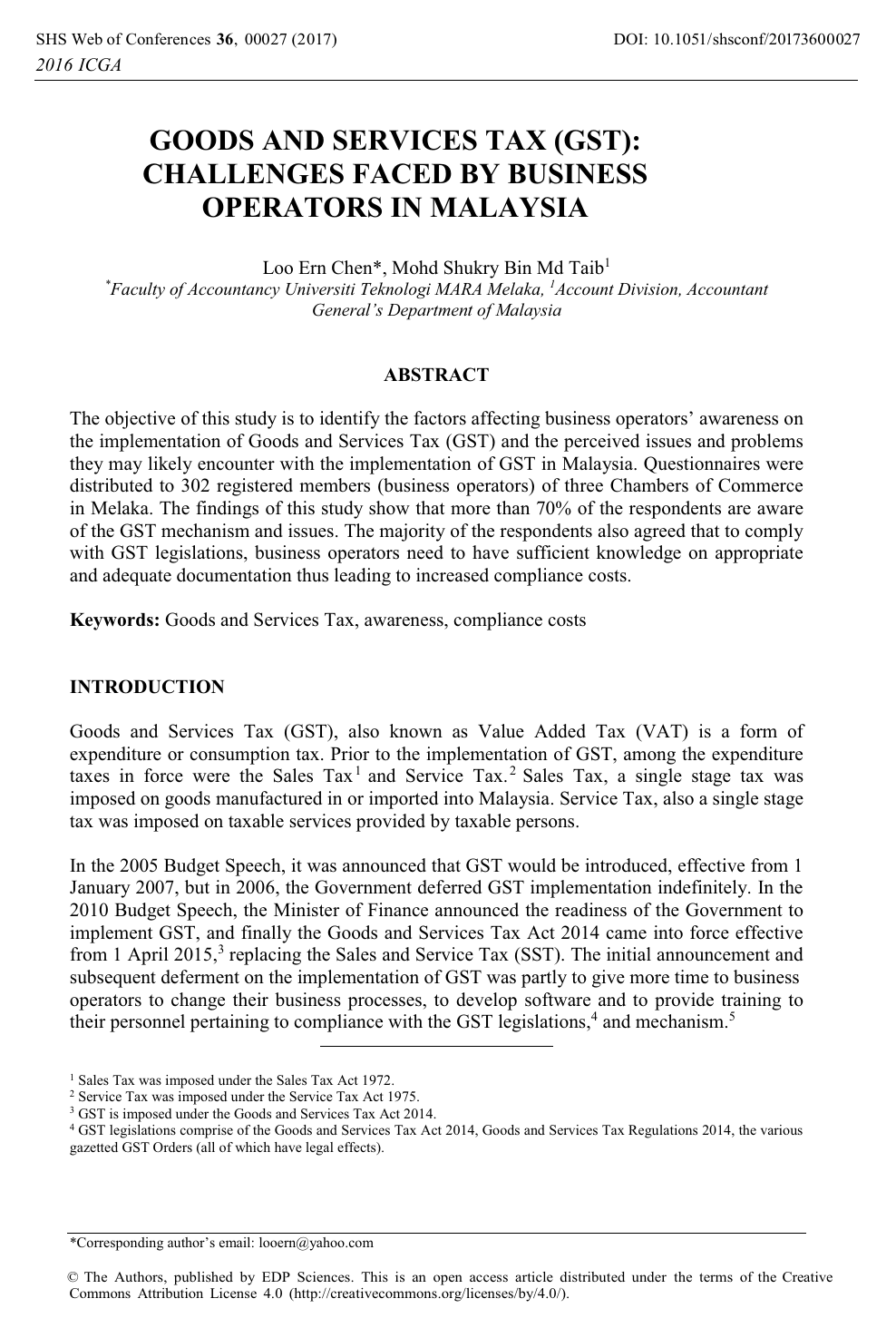

Run a business or enterprise and your GST turnover is 000 or more 0000. GST shall be levied and charged on the taxable supply of goods and services. Malaysia Indirect Tax November 2017 GST Chat All you need to know Issue 112017 1 GST - Budget 2018 2 GST Technical Updates 3 Public Ruling on Penalties and Healthcare Services Other tax information Deloitte contacts.

Yes if the purchase was made 3 months before the tourist departs from Malaysia. Revenue stream in scope. Decision by GST officer Review application by Director General by an advocate or a tax agent or by both an Malaysia 1983 CLJ.

We didnt understand rate rates and code websites. Written by Stanley K Wong. Updated GST Audit File v20 The.

The Goods and Services Tax GST is an abolished value-added tax in Malaysia. From changes in tax codes some added some removed to changes in the GST-03 as well as GST Audit File reporting formats. The existing standard rate for GST effective from 1 April 2015 is 6.

A new tax code at the rate of 0 need to be created SR-0 or any code that the company uses for standard rated local supplies at 0 on or after 01 June 2018. GST Electronic Services Taxpayer Access Point TAP Handbook. GST is levied on most transactions in the production process but is refunded with exception of Blocked Input Tax to all parties in the chain of production other than the final consumer.

Tax code As at 01 June 2018 1736. Deemed input tax relating to insurance or takaful cash payments. Streamline GST Treatment for Warehousing Scheme Designated Area and Free Zone.

Jun 27 201727 June 2017 We request you to kindly suggest our Products GST HSN Code and rate of Tax. Within this context medicines are subjected to GST. General Guide revised as at 24 August 2017 Handbook for GST for Businesses.

Since the introduction of GST in April 2015 there have been changes in the way we record and report GST. 2 Tax Code on Adjustme nt for. What tax code is to be used for supply of goods services made on or after 01 June 2018 and how it is supposed to be declared in GST-03.

At the end of last. Tax Code Description GST-03 OS-TXM 0 This refers to out-of-scope supplies made outside Malaysia which will be taxable if made in Malaysia. Customs Duties Exemption Order 2017.

GST is levied on most transactions in the production process but is refunded with exception of Blocked Input Tax to all parties in the chain of production other than the final consumer. Budget 2017 Updates for. Malaysia Indirect Tax April 2017 Indirect Tax GST Chat All you need to know Issue 042017 In this issue 1 GST Technical Committee Meeting Update 2 Update of the National Essential Medicines List and the Controlled Drug list 3 Changes to the Customs and Excise Duties Orders Other tax information Deloitte Contacts.

Goods and services tax. Greetings from Deloitte Malaysias Indirect Tax Team Greetings everyone and welcome to the November instalment of GST Chat. The recent changes that came into effect in 2018 include the following 4 compliance updates as follows.

Users can now easily record and track the GST posting date in the Purchases Module in MYOB software. Written by Stanley K Wong. The Impacts of Tax Administration Digitalization to GST Registrants.

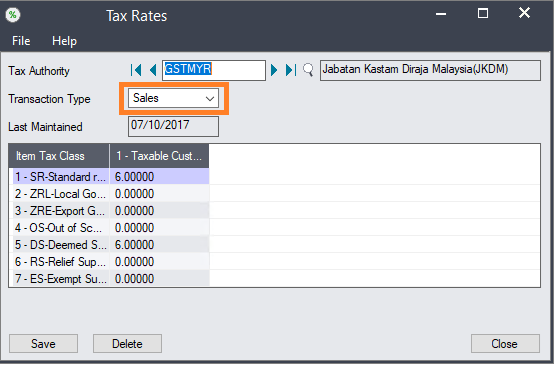

2017 Information on the transposition from HS Code 9 -digitto HS Code 10 Practical application of the HS 2017 in Malaysia. Download form and document related to RMCD. The tax codes list window displays all the GST codes available in MYOB.

GST shall be levied and charged on the taxable supply of goods and services. Tax filers may be in for some jolts thanks to the tax law that hurled through congress late last year and was signed by president donald trump with breathtak. Tax Code For Supplies - 9 Codes 9 1 Tax Code For Purchas es - 14 Codes 14 Tax Code For Supplies - 10 Codes 10.

9789670853314 eBook Malaysia Master GST Guide 2017 3rd Edition Richard Thornton Thenesh Kannaa Book MYR23000 No SST eBook MYR24380 including SST Malaysia Master GST Guide 2017 provides a clear concise and practical. Scrub PadGreen Pad 8. Affected business modelsin-scope activities.

Gst tax code list malaysia 2017 52022 dated March 25 2022 unveils an Amnesty Scheme 2022 to settle outstanding tax dues pertaining to the period before GST introduction. Input tax allowed on the acquisition of goods or services under Islamic financial arrangement. You need to register for goods and services tax GST if you.

GST Code Description TX-FRS.

Setting Gst To 0 In Sage 300 Sage 300 Malaysia

What Is Gst All That You Need To Know About Gst Ipleaders

Abolition Of Gst And Transition To Sst In Malaysia Activpayroll

Goods And Services Tax Gst Challenges Faced By Business Operators In Malaysia Topic Of Research Paper In Economics And Business Download Scholarly Article Pdf And Read For Free On Cyberleninka Open

Gst Goods And Service Tax Act 2017 Amended Up To 2020 1st Edition 2020

Setting Gst To 0 In Sage 300 Sage 300 Malaysia

Cbic Amended Notification No 1 2017 Central Tax Rate To Prescribe Change In Cgst Rate Of Goods A2z Taxcorp Llp

Gst Portal Provides Simple To Use Offline Utility For Uploading Invoice Data And Other Records For Creating Gstr 1 Accounting And Finance Worksheets Offline

Some Restaurants Charging Vat Service Tax Too Besides Gst Deccan Herald

Goods And Services Tax Gst Indpaedia

Comparison Between Gst Sst Download Table

Pdf Goods And Services Tax Gst In Malaysia Behind Successful Experiences

Gst To Subsume Sales Tax Vat Service Tax And Much More Details Here

The Brief History Of Gst Goods And Service Tax

India S New Gst Invoice Format Manager Forum